In forex trading, few situations are as frustrating as a breakout that turns out to be false. A trader sees a currency pair breaking out of a range or key level, decides to enter the trade with confidence, and then within minutes or hours, the market reverses, triggering stop-losses and wiping out profits. This is the essence of a false breakout.

Understanding how to identify and avoid these traps is a vital skill for traders at every level. The foreign exchange market thrives on liquidity and volatility, and false breakouts are a natural part of the way price moves. However, with careful analysis and the right strategies, traders can learn to filter genuine breakouts from false ones.

What is a False Breakout?

A false breakout occurs when the price moves beyond a support or resistance level, suggesting a potential continuation in that direction, but quickly reverses and moves back into its prior range.

For example:

- Price breaks above a resistance level at 1.1200, sparking interest from breakout traders.

- Many traders enter long positions, expecting the momentum to push prices higher.

- However, instead of following through, the price falls back below 1.1200, trapping traders and often leading to losses.

False breakouts are not accidents. They often result from market dynamics, where larger players (such as institutions or banks) exploit liquidity around key levels by triggering stop orders and absorbing positions.

Why Do False Breakouts Happen?

To understand how to identify false breakouts, it is necessary to first know why they occur. Some common reasons include:

Liquidity Hunts (Stop Runs)

Large market participants often seek liquidity to enter big positions. They know many traders place stop-loss orders around obvious support and resistance levels. By pushing the price just beyond these levels, they trigger these stops, creating the liquidity needed for their trades.

Market Overreaction to News

Economic data releases or central bank comments can create sudden volatility. Traders may react emotionally, pushing the price temporarily beyond key levels before the market corrects itself once the initial shock fades.

Low Volume Breakouts

Not all breakouts are supported by strong trading volume. A breakout that occurs on weak volume is more likely to be false, as it lacks the momentum needed to sustain the move.

Range-Bound Conditions

In consolidating markets, price frequently tests support and resistance levels. Many of these tests lead to temporary breaches rather than true breakouts, resulting in repeated false signals.

How to Spot a False Breakout

While no method is foolproof, there are reliable techniques that can help traders filter out false signals.

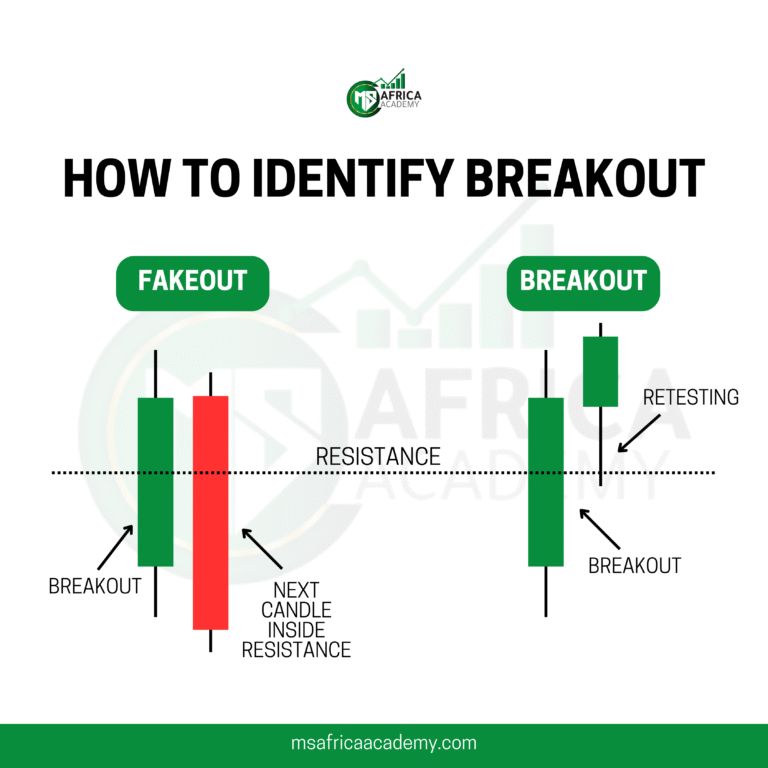

1. Look for Confirmation Candles

A breakout should be confirmed by more than just one candle closing beyond a level. If price quickly returns inside the range within the next candle or two, the breakout is likely false. Traders should wait for at least one or two strong closes beyond the level before acting.

2. Pay Attention to Volume

Volume acts as the fuel for price movement. A genuine breakout usually comes with a surge in volume. If the breakout occurs on weak or declining volume, it signals a lack of conviction and raises the likelihood of a reversal.

3. Use Multiple Time Frames

Checking the breakout on higher time frames (such as the 4-hour or daily chart) provides perspective. A breakout that looks convincing on a 15-minute chart may appear insignificant when viewed on a daily chart. Always align trades with the broader context.

4. Analyse the Retest

Often, genuine breakouts are followed by a retest of the broken level. For instance, if price breaks above resistance, it may come back to retest that level as support before continuing higher. If the retest fails and price quickly collapses back, the breakout was likely false.

5. Be Aware of Timing

False breakouts often occur during low-liquidity sessions, such as the Asian trading session, when price movements are easier to manipulate. Breakouts that occur during major sessions (London or New York) tend to carry more weight.

Practical Strategies for Avoiding False Breakouts

Wait for a Close Beyond the Level

Entering a trade the moment price pokes above or below a level is risky. Instead, wait for the candle to close beyond the level to confirm the breakout.

Combine Technical Indicators

Use tools such as the Relative Strength Index (RSI), Moving Averages, or Bollinger Bands to filter signals. For example, if RSI is showing overbought conditions during a breakout, caution is warranted.

Use a Smaller Position Size Near Breakout Points

Reduce risk by starting with smaller positions when trading breakouts. If the move is genuine, there will often be time to scale in.

Employ Stop-Loss Placement Wisely

Instead of placing stops at obvious levels just beyond support or resistance, consider wider stops that avoid being hunted by liquidity spikes. This must be balanced with proper risk management.

Look for Confluence

A breakout that aligns with other technical factors, such as Fibonacci retracement levels, trendlines, or key psychological price points (like round numbers), has a higher chance of being valid.

False breakouts are an unavoidable part of forex trading, but they do not have to be costly traps. By understanding why they occur and using a structured approach to identify them, traders can significantly reduce unnecessary losses.

The key is patience and discipline. Instead of reacting emotionally to every movement beyond a line on the chart, a trader should step back, look for confirmation, and evaluate the bigger picture. The more carefully one learns to distinguish between real momentum and deceptive traps, the more consistently profitable trading becomes.

Ready to sharpen your trading skills and learn how to avoid costly mistakes like false breakouts?

Join us at MS Africa Academy, where traders are equipped with practical strategies and the confidence to trade smarter.

Come and learn with us today.